The New Silk Road – The Vision of an interconnected Eurasia

Our time is a time of disillusion. Skepticism and short-term thinking are typical behaviors of business professionals. Thus people with big ideas often seem untrustworthy in the eyes of many. Efficiency, ROI and quarterly EBITDA dictate the daily business decisions and sometimes appear to prohibit grand visions – not so with the vision of the New Silk Road.

According to a Chinese proverb, a journey of 1,000 miles starts with the first step. And what started out as two regular routes emerging from booming high-tech zones in the Chinese cities of Chongqing and Chengdu, rapidly grew into a 39 route interconnected transport network linking Asia and Europe. Cheaper than air and faster than sea freight, the New Silk Road is building up strong momentum with freight forwarders across Eurasia. To understand the drivers, current operations and prospects of this gigantic project, Combined Transport interviewed Karl Gheysen (CEO of Khorgos Gateway) in Berlin.

When shedding light on the New Silk Road development, analysts often mention China first. Since becoming China’s president in 2013, Xi Jinping has kicked-off a series of both domestic and foreign policy initiatives. Arguably, one of the most significant projects in this context is the New Silk Road, today more often referred to as the “One Belt, One Road” (OBOR) initiative.

At the same Kazakhstan has played a fascinating role in the development of OBOR. As the 9th largest country in the world, Kazakhstan is landlocked in between China, Russia, and the Caspian Sea, which is why it has an important geostrategic location. Historically it has long served as a way-station along the 2,000-year-old Silk Road, connecting Asia and Europe. Generating roughly 60% of its GPD though the oil industry, the Kazakh president Nazarbayev saw that investments and diversification into other industries were a necessary decision to take when the world financial crisis hit the country and oil prices as well as exports declined. Karl Gheysen, CEO of Khorgos Gateway remembers: “After 2007/8, Nazarbayev started promoting the idea of reactivating the old trade paths of the Silk Road. A substantial $200 million USD investment into an inland port followed which became operational in 2015, to interconnect the Chinese and Russian railway system. Close partnerships with China were formed, and in December 2016, the 1,000th block train from China was arriving in Europe.”

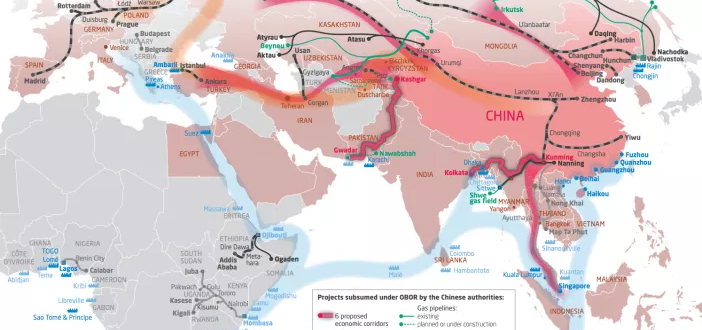

Where are the corridors of the New Silk Road located?

Drawing heavily on historical imagery of the old Silk Road that ran from China to Europe through Central Asia, OBOR envisions to create a land-based industrial belt to connect mainland China with Europe by rail. However, as theses connections grow, the network branches out from Kazakhstan to for example Iran, Turkey, Pakistan and other economies along the way. The second part to OBOR is the “Maritime Silk Road” which will run from China to the Indian Ocean via Southeast Asia. Within this context, then, specific infrastructure investments including rails, roads, pipelines and ports are being developed.

Looking back at 2014, Xi Jinping concluded investment deals worth $30 billion USD with Kazakhstan, $15 billion USD with Uzbekistan, and $3 billion USD with Kyrgyzstan, in addition to spending $1.4 billion USD to help revamp the port of Colombo in Sri Lanka. By November 2014, China had announced the creation of a $40 billion USD Silk Road Fund. The Silk Road Fund has expressly been created and used to invest in OBOR projects. In summer 2016, finance ministers from almost 60 countries were holding the first annual meeting in Beijing to agree on the financial strategy at the Asian Infrastructure Investment Bank (AIIB). Like a steam train pulling noisily out of a station, the New Silk Road initiative is gradually gathering speed.

Why are countries investing in OBOR?

Analysts have suggested various rationales. Firstly, countries along the belt are focused on ensuring political stability by delivering high economic growth. Hence, infrastructure projects create jobs for thousands of blue-collar workers, who will spend their wages to consume products and services and increase national wealth creation along the belt. Especially the Chinese leadership hopes that the OBOR initiative stabilizes Beijing’s western provinces, as well as the nearby trouble spots, like Pakistan or Afghanistan. As China finances most infrastructure projects, the communist party is also strategically positioning itself to increase its political influence in the years to come.

Furthermore, China needs to ensure secure energy supply routes and open up new market opportunities for both its established low-value and its increasing volume of high-value goods. OBOR could potentially deliver both. China’s leaders calculate that the trade lines will touch 4.4 billion people in more than 65 countries and that annual trade with participant nations could climb to $2.5 trillion USD within a decade. The New Silk Road has the potential to reinforce established partnerships and build new ones with energy exporters in Central Asia, the Middle East, and Africa.

The market niche – Faster than sea and cheaper than air

Currently, the choice to ship goods from Asia to Europe is two-fold. One, take an ocean-bound route, which, although cheap, is slow. Two, use an air carrier that is considerably faster, but much more expensive. The New Silk Road train appeals to customers who have time-sensitive goods, such as merchandise to be sold as part of special promotions in the apparel industry or capital-intensive goods such as automotive parts or electronics.

Karl Gheysen sees that: “The New Silk Road is booming due to very good reasons. Firstly, most of the manufacturing facilities, e.g. for high-value products like HP computers, are located in the mainland of China. For the goods to arrive at a Chinese port they have to travel hundreds of kilometers on the road/rail in a pre-run, are then shipped via ocean freight to a European port, and finally transported on the road/rail to the final destination. With the new Silk Road, HP stacks its computers into containers which are then loaded onto a train and send directly westwards. The containers are swapped in the inland terminals of Khorgos (Kazakstan) and Małaszewicze (Poland) to interconnect the railway systems of China, Russia and Western Europe. Compared to ocean freight, the shipment process of the computers is significantly reduced, which increases the throughput rate, reduces the financing of stock and hence frees up cash for HP. As a result, the total cost of operations is impacted positively, which is why companies like HP have shifted to the rail.”

So goods travelling to Europe via the maritime route take a relatively long time to reach their destinations anywhere between 25 to 45 days. In contrast, a train from Chongqing (China) to Duisburg (Germany) can deliver the same goods in 14 days – half that time. In general, the transit time depends on certain factors which influence the operational production of the transport like the relation (loading/unloading/hub location), the volume (block-train or single container), and the chosen pre-/on-carriage system selected for the last mile (trucking or railing ex-border). On average, the transit from China to Europe on the New Silk Road is about 14 to 18 days for block-trains and 18 to 21 days for single container shipments.

According to Far East Land Bridge Ltd., the New Silk Road train journey also saves 75% of the carbon footprint of the ocean route while running only 11,000 km instead 22,000 km on the sea route. It reduces the severe congestion which exists in and around the seaports involved in the east-west container trade, by moving containers from truck to rail.

Now the interesting question is, how cold winters affect the shipments, as temperatures can fall to 40 degrees below zero in Central Asia and Russia. The Dutch company 45Unit markets diesel/electric reefer containers that provide a solution. The reefer containers produce heat during cold winters and can refrigerate perishable goods during hot summers, which mitigates the temperature risk. Trains running on the Silk Road today carry these reefer containers, which can be leased by operators.

Railway systems differ from region to region – how is seamless transport even possible?

As railway systems have different specifications from region to region across the globe, for instance, they differ by gauge (width of rail), catenary systems, signaling systems or tunnel profiles. It is therefore technically impossible to have the same block train running from China to Europe or vice versa. As mentioned before, the trick is to load the goods in containers which can be swapped from one train configuration to another in a fast, safe and economically feasible way. The containers serve the function of a standardized adapter that is interchanged at strategically well-positioned hubs (inland or dry ports). This way, a seamless shipment of goods is possible and interconnected transport networks can be built – similar to ocean freight transport routes.

One of these strategic hubs is the dry port of Khorgos in Kazakstan. ”When people ask me how far the Chinese train ride is, I answer them that it stops here. We have special cranes which are almost masterpieces. Those big yellow cranes are used to unload Chinese trains and load Kazakh ones. Kazakh trains go in different directions, to Central Asia, Europe, Iran, Turkey and so on. When people talk about a New Silk Road and connection of the Western part of China with the Western part of Europe, I say that this is the place where the East meets the West,” said Karl Gheysen, CEO of Khorgos Gateways.

Khorgos dry port is situated at the border-crossing between Kazakhstan and China and is Central-Asia’s first terminal of this size with both broad and narrow rail access for serving Kazakh and Chinese trains simultaneously. Gheysen adds: “In 2012 when we started conceptualizing the project, there was nothing but sand here. Then we welcomed the first train in 2015 which was un-/loaded using a reach stacker. Today our terminal operates multiple portal cranes, has an annual capacity of 540,000 TEU and can serve hundreds of railcars per day. The average number of trains we get in Khorgos is three to six per day. Our highly trained workforce has grown from 0 to 150 people in 4 years, and we are continuing to expand our operations step by step.”

To improve operational productivity, Khorgos has digitalised its processes from the beginning. The terminal runs the logistics management software of Navis. Navis offers a terminal operating system to manage the planning and operational process execution. The business intelligence functionality allows Gheysen’s team to track, measure and understand its overall performance. Hence the Khorgos dry port can pro-actively identify disruptions, bottlenecks, and trends and manage the container shipments in a highly efficient way.

But Khorgos Gateway is not only a container swapping hub. It will ultimately offer the largest new logistics park in the entire Central Asian region with planning consent for future expansion of total 4.500 Ha. The company is currently in the sales process of a minority stake, and a Chinese acquisition is likely to take place in 2017.

Who are the operators and what are the train connections?

Multiple train and terminal operators work hand in hand to ensure a seamless transport of the goods over the 11,000 kilometers journey. At the start, China Railway serves the East Asian transport leg. After the gauge change in Central Asia, a consortium of Russian, Kazakh, and Belarus operators typically runs trains to Poland to execute the second gauge change on the European route. Then European players like for instance, the German DB Cargo AG, the Suisse Interrail AG or the Dutch joint-venture New Silk Way Logisticstake over transport on the last leg.

The busiest European transport operator has been DB Cargo AG. “We shipped more than 40,000 containers (800,000 TEU) across the world’s longest rail route,” said Ronald Pofalla, Board Member at Deutsche Bahn. DB and its partners have been transporting automotive parts for the BMW Group from Leipzig and Regensburg to an automotive plant in the Chinese city of Shenyang. Shenyang is one of China’s largest automotive clusters, which is why DB Schenker has also invested into a brand new 42,000 square meter logistics center in a joint-venture with Jinbei Logistics. With China now offering high-quality products for the rail sector, DB also opened a purchasing office in Shanghai in late 2015.

Far East Land Bridge Ltd. has specialized in transporting 40ft DV, 40ft HC and 20ft containers from the Far East (China, South Korea, and Japan) to Russia/Europe and vice versa using the Trans-Siberian railway connection. The company reached a freight volume of 200,000 TEU with the Express in 2016 and has plans to make it 350,000 TEU in 2017.

To give you a sense of scale, the world’s largest container ships are built by Hyundai Heavy Industries Co., Ltd. (HHI) and can carry up to 19,000 TEU at a single time. Of course, there are hundreds and thousands of ships sailing the oceans today, supplying us with all the imported goods we receive from Asia and sending European exports back. And ocean shipping will continue to account for the majority of freight volumes between the two continents. If you consider that the ship is fully stacked, it would have to fulfill 40 runs to arrive at the same amount of freight, that DB Cargo AG and its partners have sent with trains via the New Silk Road belt.

To conclude, the New Silk Road is an interconnected network of transportation routes which links Asia with Central Asia, Russia, and Europe. Grounded on political will, hundreds of infrastructure projects – of which we have covered the dry terminal of Khorgos – are being invested in today, to grow capacity and trade volumes. For individual segments of shippers, which have the need to send higher-value goods from China to Europe in a rather short time yet at an affordable price, the New Silk Road train route is a real business opportunity. For the New Silk Road to operate profitably in the long-term, it is important that European transport companies jump on the band wagon and send the trains back to China loaded with their export goods. Eventually, a higher asset utilization will lead to increased margins, which then can be returned to the end customers offering lower prices on the train shipments. So go and get a quote from one of the operators below today, do the math and see where the New Silk Road can add value to your business!

Hi

Dear i have to ready all about to salik road ,very good plans i wishes u good luck