TOP 11 Incoterms You have to know as ABC!

The Incoterms® (abbreviation of International commercial terms) rules developed by the International Chamber of Commerce was created as an industry standard to facilitate international trade and for the interpretation of the trade terms that the parties to a contract of sale could agree to apply.

Currently in its 8th version, Incoterms® was first introduced in 1936 and as global trade developed and evolved, the Incoterms® rules were also revised in 1957, 1967, 1976, 1980, 1990, 2000 and 2010 to accommodate changes in global trade.

Today, these rules form an essential part of day to day international trade as well as domestic trades and they form an integral part of many sales contracts worldwide.

It is important to remember that “Incoterms” is not a generic name for international trade terms but is a trademark used to designate the rules devised by ICC.

Incoterms

Over the years, Incoterms® rules have provided guidance to importers, exporters, lawyers, transporters, insurers and others involved in international trade. They are published by the International Chamber of Commerce (ICC).

The core functions of Incoterms® is to

- Outline the obligations of the buyer and the seller in a trade transaction

- Clarify when risk passes from seller to buyer under each of these rules

- Outline how costs are allocated between the buyer and the seller

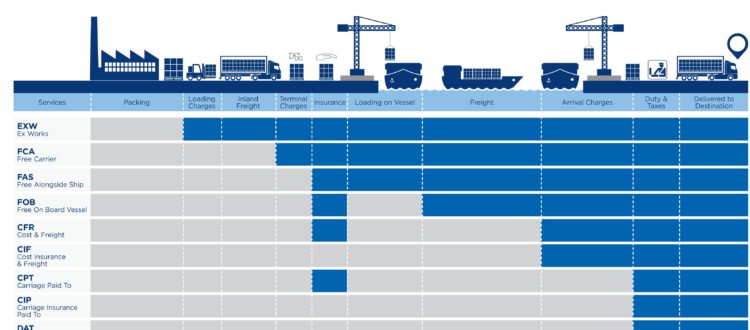

There are 11 Incoterm rules in circulation currently. They are divided into two classes:

Rules For Any Mode Of Transport

CIP (CARRIAGE AND INSURANCE PAID TO)

Rules For Sea And Inland Waterway Transport

CIF (COST INSURANCE AND FREIGHT)

EXW – Ex Works

Definition of the term

“Ex Works” means that the seller delivers when it places the goods at the disposal of the buyer at the seller’s premises or at another named place (i.e.,works, factory, warehouse, etc.). The seller does not need to load the goods on any collecting vehicle, nor does it need to clear the goods for export, where such clearance is applicable.

This rule may be used irrespective of the mode of transport selected and may also be used where more than one mode of transport is employed. EXW is mostly suitable for domestic trade.

Explanation of the term

In simple terms, if you are the buyer and you are buying the goods from the seller on EXW terms, you will need to send your truck to the seller’s premises and collect the cargo from there and take care of all the other shipping requirements to get it to your destination.

Officially the shipper is NOT obliged to do anything other than provide you access to the cargo.

Of course, based on your relationship with the seller, there may be an unofficial option wherein the shipper may assist with the loading of the goods onto your vehicle etc.

There is also an official option wherein you can include the words “LOADED” to the term EXW so that seller may extend his service to assist with the loading operations.

However, if there is any damage to the cargo during that loading process, that risk and cost may still be yours as the buyer. It is vital therefore, that this point is clarified with the shipper beforehand at the time of the signing of the sales contract.

In the case of EXW it is safe to say that the seller has minimal obligations, risks & costs whereas the buyer has all the risks and obligations.

Pro Advice

As EXW terms places all the responsibility on you as the buyer and there is no obligation on the part of the seller to do anything other than provide the cargo. It may be prudent for you as the buyer to have a reliable freight forwarder at the origin port to take care of your best interests.

FCA – Free Carrier

Definition of the term

“Free Carrier” means that the seller delivers the goods to the carrier or another person nominated by the buyer at the seller’s premises or another named place.

This rule may be used irrespective of the mode of transport selected and may also be used where more than one mode of transport is employed.

Explanation of the term

In an FCA transaction, the seller could be involved in the actual movement of the cargo upto a certain point.

This point could be the warehouse of the carrier, the warehouse of the buyer’s agent, the port or a terminal in the port or any other location agreed between the buyer and seller.

In an FCA transaction, the seller must take care of

- All pre-export documentation relating to the shipment such as port, customs, transport documentation till the point of delivery

- Export customs clearance where required

- Loading formalities if the delivery point is agreed to be the seller’s warehouse/premises

The buyer on the other hand must take care of

- The transportation of the goods from the point of delivery by the seller till cargo reaches the destination

- This could include the ocean leg as well which includes negotiating the rates with the shipping lines

- The risk of such movement from the point of delivery by the seller till the final point of rest

- The clearance of the goods at destination and any movement/risk till the final point of rest

In the case of FCA the seller’s obligations, risks and costs are till the agreed point of delivery and the buyer’s obligations, risk and costs start from that agreed point of delivery.

FCA terms could end at

- Seller’s premises

- Buyer’s agent at the port of load

- Carrier’s depot or terminal at the port of load

- Loaded on board the ship at the port of load

Pro Advice

The point of delivery needs to be expressly discussed and agreed between the buyer and the seller as the risk passes from the seller to the buyer at that point.

All the above-mentioned delivery points are at the origin and out of the control of the buyer and therefore the buyer must take due precautions when buying on FCA.

CPT – Carriage Paid To

Definition of the term

“Carriage Paid To” means that the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place (if any such place is agreed between parties) and that the seller must contract for and pay the costs of carriage necessary to bring the goods to the named place of destination.

This rule may be used irrespective of the mode of transport selected and may also be used where more than one mode of transport is employed.

Explanation of the term

In a CPT transaction the seller is obliged to deliver the goods to the agreed destination.

This agreed destination in CPT term could be any place expressly agreed between the buyer and seller and will most commonly be an overseas destination.

As part of fulfilling this obligation, the seller must

– Do the export clearance formalities

– Pay for the transportation from his door to the named and agreed destination and enter into relevant contract of carriage with the various carriers

– Take care of any and all export permits, quotas, special documentation etc relating to the cargo

It is crucial for the buyer and seller to understand that in a CPT transaction, the “risk” passes from seller to buyer once the seller delivers the cargo to the first carrier, whereas the costs up to the named destination will still be for the seller.

Because CPT term maybe use for all modes of transport, the movement could involve a road, rail and sea movement (in that order). Which means there are 3 carriers involved here.

In CPT, once the seller hands over the goods to the road carrier for further movement, the “risk” transfers from the seller to the buyer, but the cost of the movement till the point of destination still remains with the seller.

In a CPT transaction the buyer takes care of

– Any transport movement from the agreed place of destination

– The risk from the time the seller hands over the cargo to the 1st carrier as mentioned above

– The full cargo insurance portion from origin to destination

– Any and all import permits, quotas, special documentation etc relating to the cargo

– Import customs clearance and all related formalities

In CPT since the contract of carriage is arranged by the seller at his expense it is normal for the seller to use his service contract and also prepay the cost of the freight upto destination.

CPT terms could generally end at

- A seaport in the destination country

- An inland container depot in the destination country

- A door location in the destination country

Pro Advice

As with all Incoterms® it is important that the point of delivery is expressly discussed and agreed between the buyer and the seller.

When using CPT term this point becomes all the more important as the risk and cost transfers at different points and if this is not understood, it could cause penalties and additional costs to the buyer or seller.

Seller must ensure that the buyer has paid for the goods either before delivering the goods physically or before issuing the bill of lading and other release documents to the buyer.

Irrespective of whether the risk has passed from seller to buyer or not, the buyer needs to ensure that the goods are fully and properly insured as that totally the buyer’s obligation under CPT.

CIP – Carriage and Insurance Paid To

Definition of the term

“Carriage and Insurance Paid to” means that the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place (if any such place is agreed between the parties) and that the seller must contract for and pay the costs of carriage necessary to bring the goods to the named place of destination.

This rule may be used irrespective of the mode of transport selected and may also be used where more than one mode of transport is employed.

Explanation of the term

In a CIP transaction, as the name suggests, apart from the delivery of goods to the named destination, the seller is also obliged to arrange for insurance to cover the buyer’s risk of loss of or damage to the goods during carriage.

This agreed destination in CIP term could be any place expressly agreed between the buyer and seller and will most commonly be an overseas destination.

As part of fulfilling this obligation, the seller must

– Do the export clearance formalities

– Pay for the transportation from his door to the named and agreed destination and enter into relevant contract of carriage with the various carriers

– Arrange and pay for the insurance to cover the buyer’s risk

– Take care of any and all export permits, quotas, special documentation etc relating to the cargo

It is crucial for the buyer and seller to understand that in a CIP transaction, the “risk” passes from seller to buyer once the seller delivers the cargo to the first carrier, whereas the costs upto the named destination will still be for the seller.

Because CIP term maybe use for all modes of transport, the movement could involve a road, rail and sea movement (in that order). Which means there are 3 carriers involved here.

In CIP, once the seller hands over the goods to the road carrier for further movement, the “risk” transfers from the seller to the buyer, but the cost of the movement till the point of destination still remains with the seller.

In a CIP transaction the buyer takes care of

– Any transport movement from the agreed place of destination

– The risk from the time the seller hands over the cargo to the 1st carrier as mentioned above

– Any additional insurance coverage over and above the minimum insurance coverage that the seller covers

– Any and all import permits, quotas, special documentation etc relating to the cargo

– Import customs clearance and all related formalities

In CIP since the contract of carriage is arranged by the seller at his expense it is normal for the seller to use his service contract and also prepay the cost of the freight upto destination.

CIP terms could generally end at

- A seaport in the destination country

- An inland container depot in the destination country

- A door location in the destination country

Pro Advice

As with all Incoterms® it is important that the point of delivery is expressly discussed and agreed between the buyer and the seller.

When using CIP term this point becomes all the more important as the risk and cost transfers at different points and if this is not understood, it could cause penalties and additional costs to the buyer or seller.

In CIP terms, while the buyer might enjoy the benefits of the insurance cover secured by the seller, the buyer must also be aware that in CIP terms, the seller is only obliged to take the minimum insurance coverage to cover the buyer’s risks.

As an indication, Institute Cargo Clauses cover is available in categories A, B and C of which category C is the minimum cover and this is what the seller may go for.

If you as the buyer feel that this coverage is limited, then you must negotiate/discuss this with seller to extend the cover to Categories B and A at an extra cost.

Seller must ensure that the buyer has paid for the goods either before delivering the goods physically or before issuing the bill of lading and other release documents to the buyer.

Irrespective of whether the risk has passed from seller to buyer or not, the buyer needs to ensure that the goods are fully and properly insured as that totally the buyer’s obligation under CIP.

DAT – Delivered At Terminal

Definition of the term

“Delivered at Terminal” means that the seller delivers when the goods, once unloaded from the arriving means of transport, are placed at the disposal of the buyer at a named terminal at the named port or place of destination.

“Terminal” includes any place, whether covered or not, such as a quay, warehouse, container yard or road, rail or air cargo terminal. The seller bears all risks involved in bringing the goods to and unloading them at the terminal at the named port or place of destination.

This rule may be used irrespective of the mode of transport selected and may also be used where more than one mode of transport is employed.

Explanation of the term

In a DAT transaction, the seller is obliged to deliver the cargo to a mutually agreed and nominated terminal.

This agreed terminal could be a terminal either part of a seaport or away from the seaport in an inland location.

As part of fulfilling this obligation, the seller must

– Do the export clearance formalities

– Pay for the transportation from his door to the named terminal

– Enter into relevant contracts of carriage with the various carriers up to the named terminal

– Take care of any and all export permits, quotas, special documentation, etc. relating to the cargo

– All risk up to the agreed point of delivery

– Must ensure that the goods arrive at the destination.

In a DAT transaction, the buyer takes care of

– Any transport movement from the agreed place of destination

– Any risk after cargo has been delivered at the agreed destination

– Any insurance past the point of delivery

– Any and all import permits, quotas, special documentation etc relating to the cargo at destination

– Import customs clearance and all related formalities

DAT terms could generally end at

- A seaport or a specific terminal within the port in the destination country

- A nominated customs bonded inland container depot or terminal in the destination country

Pro Advice

The seller needs to be aware that under DAT terms, the seller is responsible for making sure that the goods are delivered at the agreed place.

So, apart from ensuring that the goods are loaded from origin, the seller also has to take care to make sure that there are no transshipment issues and the cargo reaches the agreed destination.

If you are a seller trading under DAT terms, you need to take some precautions to protect yourselves from any unforeseen or reasonably unforeseeable circumstances that may prevent you from delivering as per the DAT terms.

In this context, CISG (Contracts for the

International Sale of Goods) or other corresponding provisions in the relevant national Sale of Goods Acts may provide the seller some relief.

Another crucial point to be remembered whether you are a seller or buyer is that under DAT, neither the buyer nor the seller is obliged to insure the goods and this insurance requirement is not specifically covered in the Incoterms® rules. This crucial issue must be discussed and agreed upon as part of the sales contract and terms of sale.

As with all Incoterms® it is important that the point of delivery is expressly discussed and agreed between the buyer and the seller.

DAP – Delivered At Place

Definition of the term

“Delivered at Place” means that the seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination. The seller bears all risks involved in bringing the goods to the named place.

This rule may be used irrespective of the mode of transport selected and may also be used where more than one mode of transport is employed.

Explanation of the term

DAP may be considered as a small extension of DAT since in DAP terms, the seller is obliged to deliver the cargo to a mutually agreed destination further than the terminal.

This agreed terminal could be the buyer’s own premises or any place as mutually agreed.

As part of fulfilling this obligation, the seller must

– Do the export clearance formalities

– Pay for the transportation from his door to the agreed destination

– Enter into relevant contracts of carriage with the various carriers up to the name destination including any on-carriages applicable

– Take care of any and all export permits, quotas, special documentation, etc. relating to the cargo

– All risk up to the agreed point of delivery

– Must ensure that the goods actually arrive at the destination.

In a DAP transaction, the buyer takes care of

– Any transport movement from the agreed place of destination

– Any risk after cargo has been delivered at the agreed destination

– Any insurance past the point of delivery

– Any and all import permits, quotas, special documentation, etc. relating to the cargo at destination

– Import customs clearance and all related formalities

DAP terms could generally end at

- Buyer’s premises or warehouse

- Their agent’s premises or warehouse

- Their customer’s premises or warehouse

- Or other inland delivery point agreed

Pro Advice

The seller needs to be aware that under DAP terms, the seller is responsible for making sure that the goods are delivered at the agreed place.

So, apart from ensuring that the goods are loaded from the origin, the seller also has to take care to ensure that there are no transshipment or on-carriage issues and the cargo reaches the agreed destination.

If you are the seller, you may still be responsible for any damage if the goods were not delivered in conformity with the DAP term contract.

Therefore, it is imperative that you ensure that the packaging of the goods is proper and good enough to withstand the movement till the agreed place.

Although the seller’s obligation ends with the delivery of the goods at the named place, in some cases the seller may be required to assist the buyer in obtaining the documents that may be required for the clearance of the imported goods. However, only the assistance will be that of the seller whereas the costs and risk for such assistance will be that of the buyer.

Buyers and sellers in trade blocs such as EU (European Union) or SADC (Southern African Development Community) may find the DAP term useful as it allows for the movement of the cargo across borders without any extra customs clearance etc.

A very crucial point to be noted in DAP is that while the seller is obliged to deliver to an inland point, this can be done only if the buyer has completed the customs formalities failing which the seller or their representative will not be able to fulfill the delivery.

Any additional costs or risks in such a case will be for the buyer.

Similarly, if there is any pre-shipment inspection required by the buyer or destination, port and customs authorities the charges for same will be for the buyer’s account unless such inspection is required mandatory by the load port authorities.

As with all Incoterms®, it is important that the point of delivery is expressly discussed and agreed between the buyer and the seller.

DDP – Delivered Duty Paid

Definition of the term

“Delivered Duty Paid” means that the seller delivers the goods when the goods are placed at the disposal of the buyer, cleared for import on the arriving means of transport ready for unloading at the named place of destination.

The seller bears all the costs and risks involved in bringing the goods to the place of destination and has an obligation to clear the goods not only for export but also for import, to pay any duty for both export and import and to carry out all customs formalities.

This rule may be used irrespective of the mode of transport selected and may also be used where more than one mode of transport is employed.

Explanation of the term

DDP may be considered as a term at the other end of the trade spectrum in terms of obligations as compared to EXW where the buyer has the maximum obligation.

In DDP, the seller has the maximum obligation as it involves the delivery of the goods to the buyer at the agreed destination.

So, if you are the buyer buying on DDP basis, you can take a seat and relax while the seller will

– Do the export clearance formalities

– Pay for the transportation from his door to the agreed destination

– Enter into relevant contracts of carriage with the various carriers up to the agreed destination including any on-carriages applicable

– Take care of any and all export permits, quotas, special documentation, etc. relating to the cargo

– Cover all risk up to the agreed point of delivery

– Ensure that the goods actually arrive at the destination

– Take care of customs clearance formalities at the destination port(s), pay the duty, VAT and other local charges applicable

In a DDP transaction, the buyer only needs to take care of

– Any further transport movement from the agreed place of destination

– Any risk after cargo has been delivered at the agreed destination

– Any insurance past the point of delivery

DDP terms could generally end at

- Buyer’s premises or warehouse

- Their agent’s premises or warehouse

- Their customer’s premises or warehouse

- Or other inland delivery point agreed

Under DDP terms neither the buyer nor the seller is obliged to insure the goods and this insurance requirement is not specifically covered in the Incoterms® rules. This crucial issue must be discussed and agreed upon as part of the sales contract and terms of sale.

Pro Advice

Although the buyer can take a back seat and let the seller do everything in a DDP trade, there are a few items that the buyer needs to be aware of.

Buyer must be aware that when using a DDP term, they could end up paying more cost to the seller because the seller’s cost includes the customs clearance costs etc.

Because the seller is not based in the country of destination, chances are that their local costs at destination may be higher than what the buyer can secure locally.

Buyer must also verify that the seller is capable of securing the import clearance directly or indirectly as otherwise there could be delays in the transaction.

Even if there is a slight doubt in this aspect, the buyer will be wiser to choose a DAP term.

The seller, in turn, needs to be confident that they will be able to handle the import clearance at the destination at the best cost for them as well.

Because the seller may lack local knowledge at the destination, their agent at destination could take them for a ride in terms of local costs which will naturally increase the seller’s price to the buyer which in the end may make them uncompetitive.

If you are a seller trading under DDP terms, you need to take some precautions to protect yourselves from any unforeseen or reasonably unforeseeable circumstances that may prevent you from delivering as per the DDP terms.

In this context, CISG (Contracts for the International Sale of Goods) or other corresponding provisions in the relevant national Sale of Goods Acts may provide the seller some relief.

If you are selling on DDP terms, it is also advisable to check if there maybe any tax advantages that can be claimed back by “residents” of the destination country.

If there are any such tax benefits for example on Service Tax paid on inland haulage by residents, then the DDP term may still be applied but with some mutually agreed proviso like “DDP Service Tax unpaid”.

This clause makes it clear that all obligations except Service Tax will be that of the seller and the buyer will take care of Service Tax and claim any tax advantages.

Although the seller’s obligation ends with the delivery of the goods at the named place, cleared, in some cases, the seller may require the assistance of the buyer in securing some documents required for the local customs clearance.

However, only the assistance will be that of the buyer whereas the costs and risk for such assistance will be that of the seller.

Similarly, if there is any pre-shipment inspection required by the buyer or destination, port and customs authorities the charges for same will be for the seller’s account unless otherwise specifically agreed between the buyer and seller.

As with all Incoterms® it is important that the point of delivery is expressly discussed and agreed between the buyer and the seller.

FAS – Free Alongside Ship

Definition of the term

“Free Alongside Ship” means that the seller delivers when the goods are placed alongside the vessel (e.g., on a quay or a barge) nominated by the buyer at the named port of shipment. The risk of loss of or damage to the goods passes when the goods are alongside the ship, and the buyer bears all costs from that moment onwards.

This rule is to be used only for sea or inland waterway transport.

Explanation of the term

Under FAS terms, the seller is required to handle all activities till the cargo is delivered alongside the ship.

This indicates that the FAS term is more suitable for non-containerised cargo because, in a containerized shipment, the containers cannot be delivered alongside the ship but rather at a container terminal.

Due to this, for containerized shipments FCA (Free Carrier) maybe more suitable.

In a FAS term shipment, the shipper should:

– Handle the export clearance formalities for shipment

– Pay for the transportation from his door to the agreed port, terminal, quay or ship

– Enter into relevant contracts of carriage with the various carriers including any pre-carriages applicable up to the agreed port, terminal, quay or ship

– Take care of any and all export permits, quotas, special documentation, etc. relating to the cargo

– Cover all risk up to the agreed point of delivery

Seller may also be requested to assist the buyer to secure a transport document indicating the delivery, at the buyer’s risk and expense.

In a FAS transaction, the buyer needs to take over all obligations from that point of delivery including

- Organise suitable contract of carriage with the most suitable carrier

- The loading of the goods on the ship

- All cargo handling charges at origin

- Arranging agents at origin where it is required to handle loading requirements

As with all Incoterms® (with the exception of CIP & CIF terms) neither the buyer nor the seller is obliged to insure the goods and this insurance requirement is not specifically covered in the Incoterms® rules. This crucial issue must be discussed and agreed upon as part of the sales contract and terms of sale.

Pro Advice

If you are a buyer buying on FAS term, it is recommended that you have a very good understanding of the required handling methods and processes at origin. If not, have a strong agent who knows the requirements at the port of loading especially relating to the “alongside” bit as it may not be as straightforward as it sounds.

As the terms are FAS, you as the buyer also need to ensure that you enter into the correct contract of carriage with the shipping line considering where the risk and cost of the seller ends and where yours begins. There could be certain gray areas in the transaction which mean you as the buyer may end up paying twice for the activity.

If you are the seller, you need to ensure that you deliver the cargo alongside the ship in time for the cargo to be loaded on board. Ships have various discharge/loading schedules in line with the ship’s stability calculations, and it is important for you as a shipper to understand this and ensure that the cargo is delivered in time.

The seller’s obligation is to ensure that the goods are delivered alongside the ship ready to be loaded.

If you are the seller, in your own interest you have to ensure that a proof of such delivery is secured. This proof of delivery could be in the form of a shipping order or the transporter’s delivery note signed by the port, terminal or ships agent when delivery is made.

FOB – Free On Board

Definition of the term

“Free on Board” means that the seller delivers the goods on board the vessel nominated by the buyer at the named port of shipment or procures the goods already so delivered.

The risk of loss of or damage to the goods passes when the goods are on board the vessel, and the buyer bears all costs from that moment onwards.

This rule is to be used only for sea or inland waterway transport.

Explanation of the term

In FOB, the seller has the obligation to deliver the goods on board the ship.

Since in FOB, goods have to be delivered on board, it may not be appropriate for goods which are handed over to the carrier before they are loaded on board, like containerized shipments.

For containerized shipments, FCA (Free Carrier) may be more suitable.

FOB, however, is still used by most people to refer to cargo for which freight is collected at the destination and where the contract of carriage is fixed by the buyer.

In an FOB term shipment, the seller should:

– Handle the export clearance formalities for shipment

– Pay for the transportation from his door till the goods are loaded on board a ship

– Enter into relevant contracts of carriage with the various carriers including any pre-carriages applicable up to the agreed point

– Take care of any and all export permits, quotas, special documentation, etc. relating to the cargo

– Cover all risk up to the agreed point of delivery

FOB term has some extensions such as “Stowed”, “Stowed and Trimmed”, etc. which are designed to ensure that the seller completes the activity of loading.

These are used when trading in cargoes such as grain or minerals which may cause stowage issues if it is left untrimmed or cargoes such as pipes, logs, which may also cause stowage issues if it is left unstowed.

In an FOB transaction, the buyer needs to take over all obligations from that point of delivery including

– Nominating the right type of ship for the loading of the cargo

– Organise suitable contract of carriage with the most suitable carrier

As with all Incoterms® (with the exception of CIP & CIF terms), neither the buyer nor the seller is obliged to insure the goods and this insurance requirement is not specifically covered in the Incoterms® rules. This crucial issue must be discussed and agreed upon as part of the sales contract and terms of sale.

Pro Advice

The seller’s obligation to place the goods onboard the ship in due time is the essence of the FOB term especially since FOB is used a lot in bulk shipments.

It must be remembered that in the past the act of the cargo passing the ship’s rail denoted the transfer of risks in FOB.

Since using the ship’s rail as a point for the division of functions, costs and risks between the buyer and seller were not considered appropriate, this was changed to placing the goods on board.

If you are a seller selling on FOB basis and accept some extensions like “FOB stowed” or “FOB stowed and trimmed”, it is recommended that you know the exact requirements linked to these words. You would be considered to have failed to fulfil your delivery obligation if the loading, stowing and trimming has not been completed.

In FOB terms since the seller has loaded the cargo on board the ship, it effectively means that the seller has handed over the goods to the carrier as well. This also means that the carrier is able to give the seller a transport document like a bill of lading which functions as the evidence of contract of carriage and also as receipt of goods.

In some cases, the seller may just receive a mate’s receipt as a receipt of goods pending the transport document till the vessel sails. In this case, the seller may be requested by the buyer to assist in securing the transport document at the buyer’s risk and expense.

If you are the seller, you need to ensure that you deliver the cargo in time for the cargo to be loaded on board. Ships have various discharge/loading schedules in line with the ship’s stability calculations, and it is important for you as the seller to understand this and ensure that the cargo is delivered in time.

If you are the buyer in an FOB term, it is of utmost importance that you nominate the right type of ship and ensure that the ship arrives in time for the seller to arrange the delivery and loading of the cargo.

If the ship is not available in time for the cargo to be loaded, that risk will pass onto you as the buyer unless you notify the seller in advance of any potential delays.

As with all Incoterms®, it is important that the point of delivery is expressly discussed and agreed between the buyer and the seller.

CFR – Cost and Freight

Definition of the term

“Cost and Freight” means that the seller delivers the goods on board the vessel or procures the goods already so delivered. The risk of loss of or damage to the goods passes when the goods are on board the vessel.

The seller must contract for and pay the costs and freight necessary to bring the goods to the named port of destination.

This rule is to be used only for sea or inland waterway transport.

Explanation of the term

In a CFR transaction the seller is obliged to arrange for the movement of the cargo to the named destination, and since CFR may be used only for waterway transport, this destination must be a destination accessible through waterways.

As part of fulfilling this obligation, the seller must

– Do the export clearance formalities

– Pay for the transportation from his door to the named and agreed destination and enter into relevant contract of carriage with the various carriers

– Take care of any and all export permits, quotas, special documentation, etc. relating to the cargo

– Pay for the loading and unloading costs of the cargo on/from the ship

It is crucial for the buyer and seller to understand that in a CFR transaction, the “risk” passes from seller to buyer once the seller delivers the cargo on board the performing vessel, whereas the costs up to the named destination will still be for the seller.

In a CFR transaction, the buyer takes care of

– Any transport movement past the agreed place of destination including on-carriage etc

– The risk from the time the seller delivers the cargo on board the ship

– Any and all import permits, quotas, special documentation, etc. relating to the cargo

– Import customs clearance and all related formalities

In CFR since the contract of carriage is arranged by the seller at his expense, it is normal for the seller to use his service contract and also prepay the cost of the freight up to destination.

CFR terms could generally end at a seaport in the destination country or a feeder port in the same or another country.

In CFR terms, the seller is obliged to provide the buyer with the required transport document – such as a bill of lading as proof of delivery and termination of his risk. The bill of lading so issued must cover the contracted goods and must be dated within the agreed period of shipment.

Based on mutual agreement, this bill of lading might also be issued as a negotiable document in case the buyer wants to sell the cargo further while in transit.

Pro Advice

For the seller and the buyer it is of utmost importance to note that when using CFR terms, the seller’s obligation in terms of risk ends once the cargo has been delivered on board the ship and not when it reaches the named destination.

For example, if the cargo is moving from Los Angeles to Antwerpen and the term is CFR Antwerpen, the seller’s risk ceases when the container has been loaded on board the ship in Los Angeles. All risks from then till Antwerpen is for the buyer while the cost is that of the seller.

But, for example, if due to weather or other circumstances the container has to be transhipped somewhere along the way the cost and risk would be that of the buyer’s.

As CFR terms are used for both containerized and non-containerised cargoes the seller needs to ensure that the proper and suitable carrier is used for the carriage, as both cargo types use different vessels, and the costs are different for both.

There is a clear difference between a liner trade and tramp trade, and it is important that the seller understand this.

If the buyer requires the seller to deliver the containerized to an inland point then a CPT would be more suitable than CFR as CFR is only for transport by waterways and does not include other modes of transport.

If the cargo is bulk or break bulk cargo, the seller needs to understand the free time allowed for the loading and unloading of the cargo failing which demurrage may be applicable.

Therefore, the seller and buyer must agree on the loading time and who must bear the demurrage if applicable.

CIF – Cost, Insurance and Freight

Definition of the term

“Cost, Insurance and Freight” means that the seller delivers the goods on board the vessel or procures the goods already so delivered.

The risk of loss of or damage to the goods passes when the goods are on board the vessel. The seller must contract for and pay the costs and freight necessary to bring the goods to the named port of destination.

This rule is to be used only for sea or inland waterway transport.

Explanation of the term

In a CIF transaction the seller is obliged to arrange for the movement of the cargo to the named destination, and since CIF may be used only for waterway transport, this destination must be a destination accessible through waterways.

As part of fulfilling this obligation, the seller must

– Do the export clearance formalities

– Pay for the transportation from his door to the named and agreed destination and enter into relevant contract of carriage with the various carriers

– Obtain and pay for cargo insurance

– Take care of any and all export permits, quotas, special documentation, etc. relating to the cargo

– Pay for the loading and unloading costs of the cargo on/from the ship

The insurance cover secured by the seller should be equal to the commercial value of the product as agreed in the contract of sale + 10% which is to cover average profit that the buyer may make.

It is crucial for the buyer and seller to understand that in a CIF transaction, the “risk” passes from seller to buyer once the seller delivers the cargo on board the performing vessel, whereas the costs up to the named destination will still be for the seller.

In a CIF transaction, the buyer takes care of

– Any transport movement past the agreed place of destination including on-carriage etc

– The risk from the time the seller delivers the cargo on board the ship

– Any and all import permits, quotas, special documentation, etc. relating to the cargo

– Import customs clearance and all related formalities

In CIF since the contract of carriage is arranged by the seller at his expense, it is normal for the seller to use his service contract and also prepay the cost of the freight up to destination.

CIF terms could generally end at a seaport in the destination country or a feeder port in the same or another country.

In CIF terms, the seller is obliged to provide the buyer with the required transport document – such as a bill of lading as proof of delivery and termination of his risk. The bill of lading so issued must cover the contracted goods and must be dated within the agreed period of shipment.

Based on mutual agreement, this bill of lading might also be issued as a negotiable document in case the buyer wants to sell the cargo further while in transit.

Pro Advice

If you are the buyer buying on CIF terms, it is imperative that you understand that the seller only has to provide minimum insurance (usually Institute Clauses C) which in most cases may be insufficient.

Therefore, it may be good to negotiate with the seller to take additional covers such as Clauses (A) or (B) of the Institute Cargo Clauses or any similar clauses and/or cover complying with the Institute War Clauses and/or Institute Strikes Clauses or any similar clauses. This additional cover would be at buyer’s expense.

While the seller is obliged to only provide minimum cover, the seller must ensure that the insurance cover is for the entire duration of the carriage till the named destination and not just till where the seller’s risk ends on board the ship.

The cover must protect the buyer from the moment he has to bear the risk of loss of or damage to the goods (i.e., from the moment the goods are loaded on board at the port of shipment) until the goods arrive at the agreed port of destination.

For the seller and the buyer it is of utmost importance to note that when using CIF terms, the seller’s obligation in terms of risk ends once the cargo has been delivered on board the ship and not when it reaches the named destination.

For example, if the cargo is moving from Los Angeles to Antwerp and the term is CIF Antwerp, the seller’s risk ceases when the container has been loaded on board the ship in Los Angeles. All risks from then till Antwerpen is for the buyer while the cost is that of the seller.

But, for example, if due to weather or other circumstances the container has to be transhipped somewhere along the way the cost and risk would be that of the buyer’s.

As CIF terms are used for both containerized and non-containerised cargoes the seller needs to ensure that the proper and suitable carrier is used for the carriage, as both cargo types use different vessels and the costs are different for both.

There is a clear difference between a liner trade and tramp trade and it is important that the seller understand this.

If the buyer requires the seller to deliver the containerized to an inland point, then a CPT would be more suitable than CIF as CIF is only for transport by waterways and does not include other modes of transport.

If the cargo is bulk or break-bulk cargo, the seller needs to understand the free time allowed for the loading and unloading of the cargo failing which demurrage may be applicable.

Therefore, the seller and buyer must agree on the loading time and who must bear the demurrage if applicable.

**This wonderful post has been taken from Xeneta.com shipping blog. Check more at their website: Xeneta.com**